We are inching towards Christmas and with the shops now open, nights drawing in it is starting to feel like winter… it even tried to snow this week.

Of course, this is year like no other, and with the pandemic, things are going to feel a little different… however hopefully it will be a nice change and distraction.

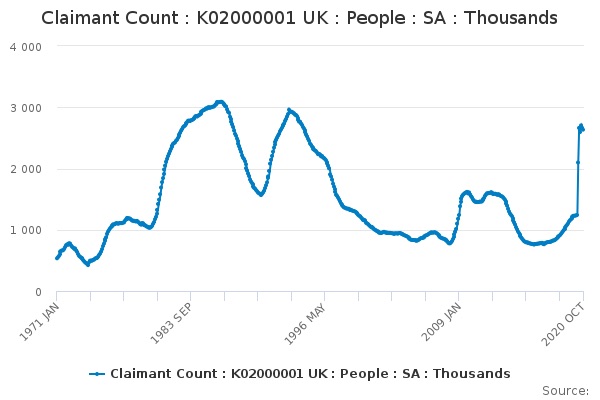

And yet even with this Christmas cheer, there is still a troubling sense of the calm before the storm, amongst many people I chat to, at least financially speaking.

This could of course be we all are just glum…bah humbug… although I would argue more likely a case of just being prepared… and looking at some of the recent stories in the news can help.

Attention to Lending Criteria

Despite mortgage demand being up and indeed credit cards being paid off, financial institutions continue to be careful with their lending criteria. As we have gathered more data throughout the pandemic, this is increasingly being fed through as extra nuance (eg performance of customers on furlough). As new data continues to roll in it is likely we will continue to see these new changes, sometimes in innovative ways.

It really does feel as if the lending world is being resegmented in a different way, and gradually the chips are now starting to fall in place.

For many customers, the fundamental willingness to pay bills has not changed, ie their character. However, due to the nature of the crisis, their ability to pay has changed… and often this time it is through no fault of their own.

The model (can’t pay, won’t pay) of course has not changed…but, with COVID19, the population in each group has changed significantly… there is just a lot more in the will pay, can’t pay box…. in thinking about customer journeys this will be a guiding influence and dominant type of contact going forward I suspect… and it is worth us being prepared.

- UK mortgage demand at highest in 13 years despite Covid crisis

- NatWest tightens rules for applicants returning from furlough

- Lloyds reintroduces 10% deposit mortgages for first-time buyers

- Virgin Money profits dive 77% as it braces for bad loans

- Late payments have escalated since the onset of the pandemic

More changes in Fin Tech

In previous articles, I mentioned some concerns raised regarding the stress this crisis could have on the new breed of startup fin tech banks… Earlier in the year Starling Bank was the first bank that looked like it would make a profit, however it now seems like it is on the block for sale.

All of this makes me think of Egg, back in the late 90’s. A real pioneer and in many ways a forerunner to many of the fin tech banks we see today. Whilst the large banks have attempted to compete in this space, will they, as was the case with Egg, just buy their way into the market, the ideas and technology instead. This is looking increasingly likely, especially if there is lending stress leading to potential bargins.

The danger of course is that on consolidation the innovation and spark is lost in the process. More developments here no doubt, and probably soon, even next year.

End of transistion ‘no deal’ looms

With the end of this year, comes the end of the transition period for the UK. With no deal yet agreed Brexit is starting to feature again.

There are of course real impacts should there be ‘no deal’. This is especially in the area of data if the UK becomes a third country and more and more concern is now being raised around the City and finance in general… to top it off £50bn has gone missing too… there is no such thing as a dull week I suppose.

- City of London faces Brexit uncertainty over access to EU markets

- Bank of England urged to investigate £50bn of ‘missing’ banknotes

… have a good weekend everyone… @chris_w_tweet

New videos